Precautionary Saving and the Transmission of Monetary Policy

Working Paper

ABSTRACT

A majority of households in the US does not hold interest bearing assets and their savings behavior is countercyclical. Using the Survey of Consumer Finances I document precautionary saving in the economy using a new measure, checking account balance to income ratio. I find that (a) medium scale NK models with a precautionary saving motive can match this ratio well; (b) precautionary saving diminishes the direct effect of monetary policy; (c) the precautionary saving mechanism leads to lower inflation during economic recoveries; and (d) an extension with downward rigid wages is able to produce an asymmetric response to monetary policy in line with the recent literature.

PDF (soon)

Household consumption-income ratio and employment risk: an empirical analysis

Working Paper

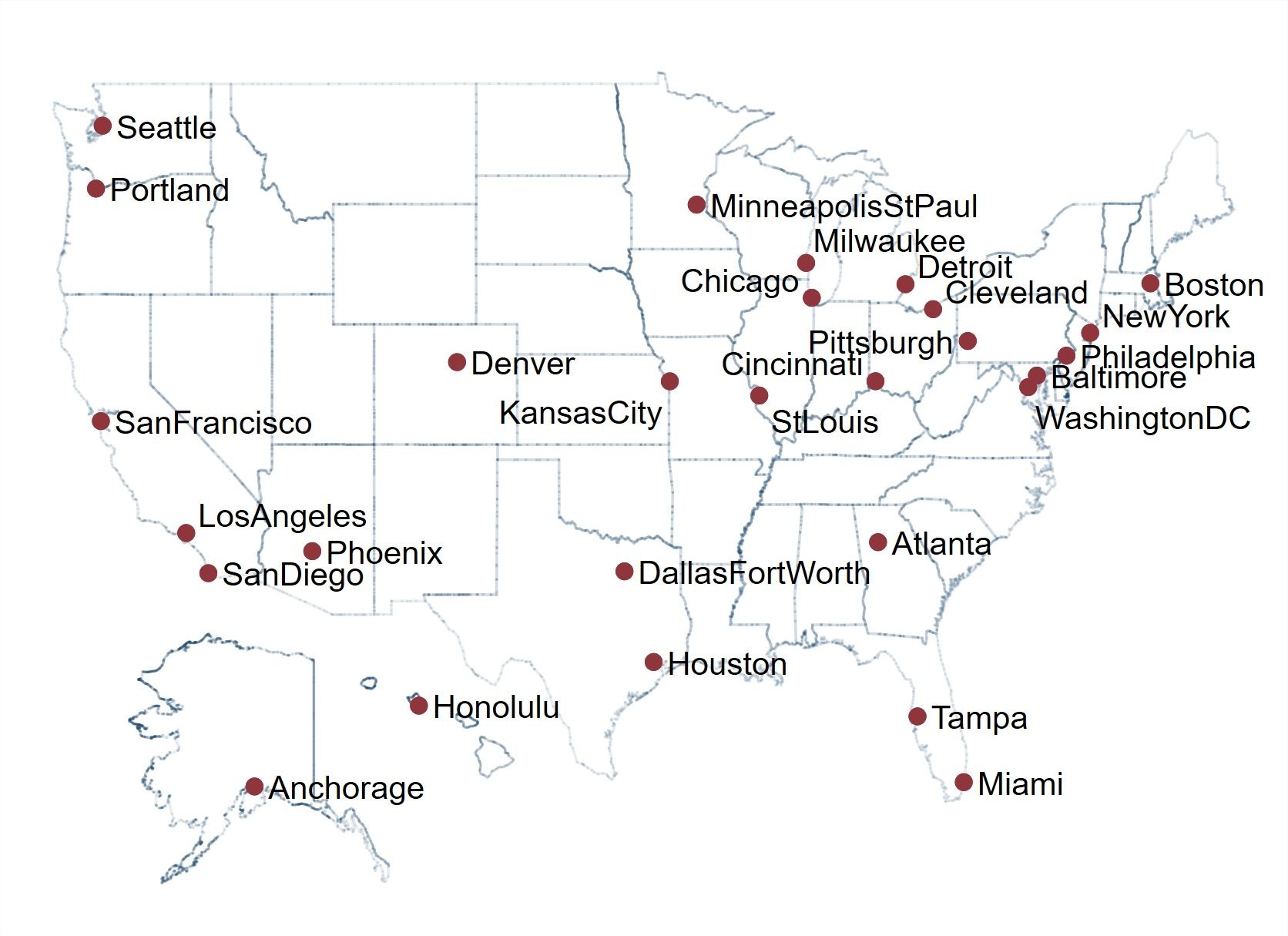

I investigate whether precautionary saving amplifies the business cycle using State and MSA level data to answer two questions: First, are business cycles amplified in low income regions compared to high income regions? And second, what role does precautionary saving play in this amplification, across regions and income? Employment and income data are taken from the BLS and ACS, and regional precautionary saving is measured as the change in consumption to change in income ratio for a subset of MSAs using CEX data. I instrument for business cycle employment shocks using the Bartik instrument, as well as the exogenous shock to mandatory federal government spending by region after Census population count adjustments.

Other Research

Precautionary Saving and Asymmetric Monetary Policy

Empirical evidence suggests that monetary policy is less effective during recessions than expansions. I find that an augmented medium scale New Keynesian model with involuntary unemployment and downward rigid nominal wages can generate asymmetric monetary policy effects and simulations of the model are in line with evidence presented in Tenreyro et.al. 2016